Condo Insurance in and around Indianapolis

Get your Indianapolis condo insured right here!

Quality coverage for your condo and belongings inside

Your Possessions Need Insurance—and So Does Your Condo Unit.

No matter your level of preparedness, the unexpected can happen. So be the condo owner who is prepared with quality insurance which may be able to help in the event of damage from smoke, hail, or weight of sleet.

Get your Indianapolis condo insured right here!

Quality coverage for your condo and belongings inside

Put Those Worries To Rest

With State Farm Condominium Unitowners Insurance, you can be assured that you property is covered! State Farm Agent Kellie Taylor is ready to help you prepare for potential mishaps with reliable coverage for all your condo insurance needs. Such personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If you have problems at home, Kellie Taylor can help you submit your claim. Keep your condo sweet condo with State Farm!

As one of the leading providers of condo unitowners insurance, State Farm has you covered. Reach out to agent Kellie Taylor today for help getting started.

Have More Questions About Condo Unitowners Insurance?

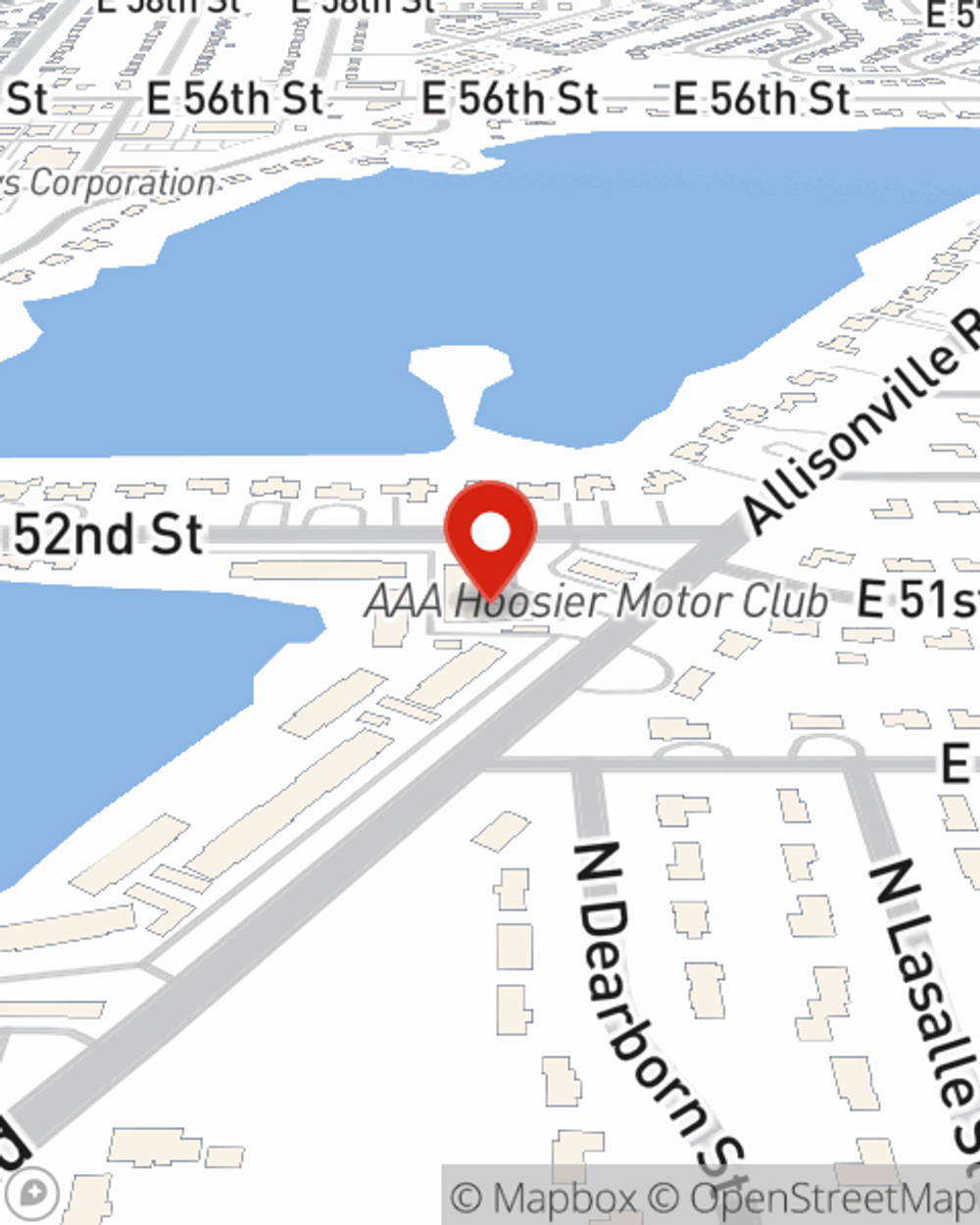

Call Kellie at (317) 842-6807 or visit our FAQ page.

Simple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Kellie Taylor

State Farm® Insurance AgentSimple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.