Business Insurance in and around Indianapolis

Looking for small business insurance coverage?

This small business insurance is not risky

Help Protect Your Business With State Farm.

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Kellie Taylor help you learn about great business insurance.

Looking for small business insurance coverage?

This small business insurance is not risky

Get Down To Business With State Farm

Did you know that State Farm has been helping small businesses grow since 1935? Business owners like you have turned to State Farm for coverage from countless industries. It doesn't matter if you are a home cleaning service or a painter or you own a dental lab or a shoe repair shop. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Kellie Taylor. Kellie Taylor is the person who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to understand your small business insurance options

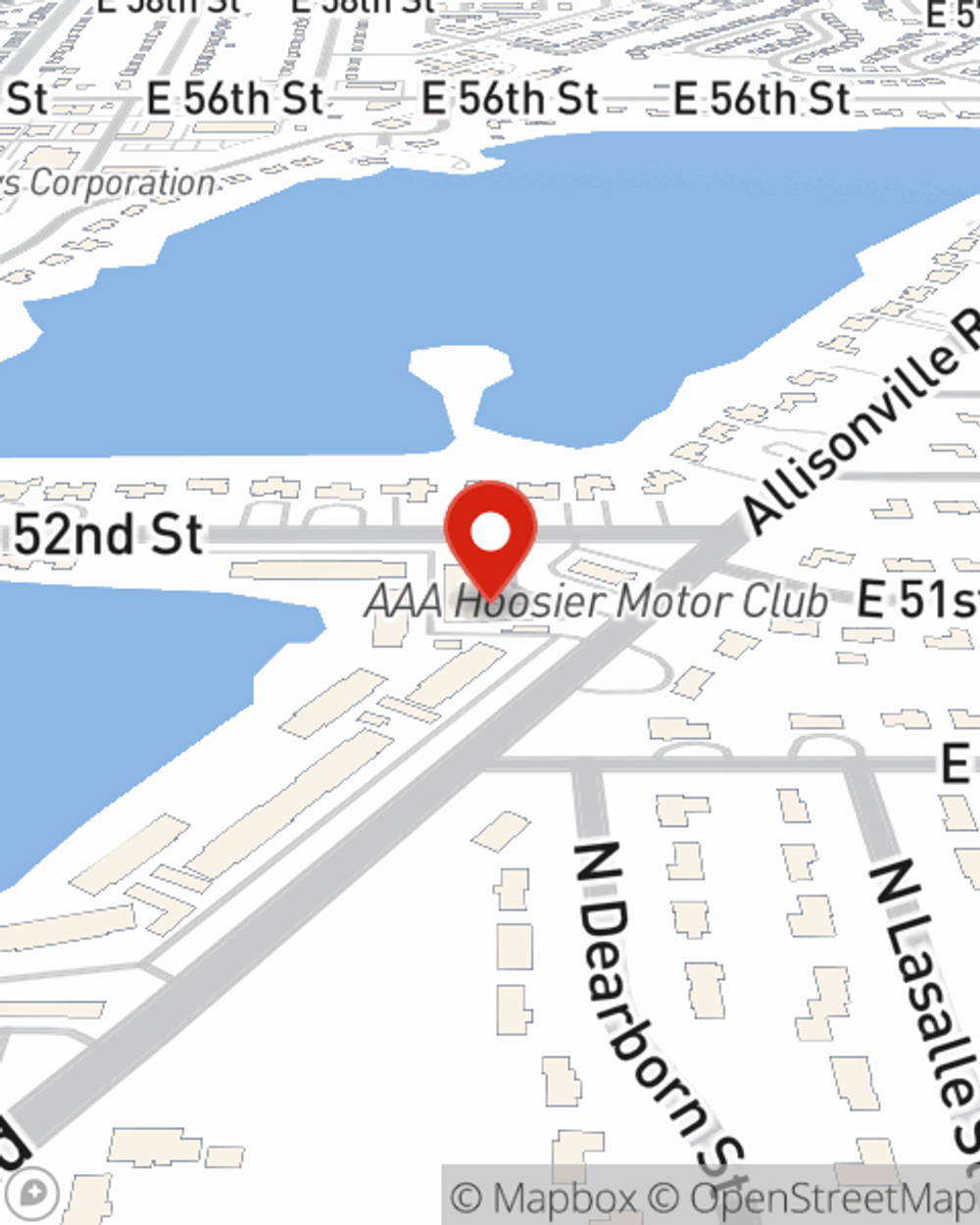

Get in touch with State Farm agent Kellie Taylor today to explore how one of the leading providers of small business insurance can safeguard your future here in Indianapolis, IN.

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Kellie Taylor

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.